The truth behind the 5 biggest myths about TCA

Despite the obvious benefits, there are still misconceptions preventing businesses from implementing TCA.

We’ve helped our clients cut their FX costs by 88.15% on average and improve the returns on their cash balances.

Find out how much you could save with our free & independent Transaction Cost Analysis and Cash Optimisation review.

88.15%

saving on average*

15

tier 1 counterparty banks

$543bn+

annual FX Volume**The benefits of independent cost analysis

Full Transparency

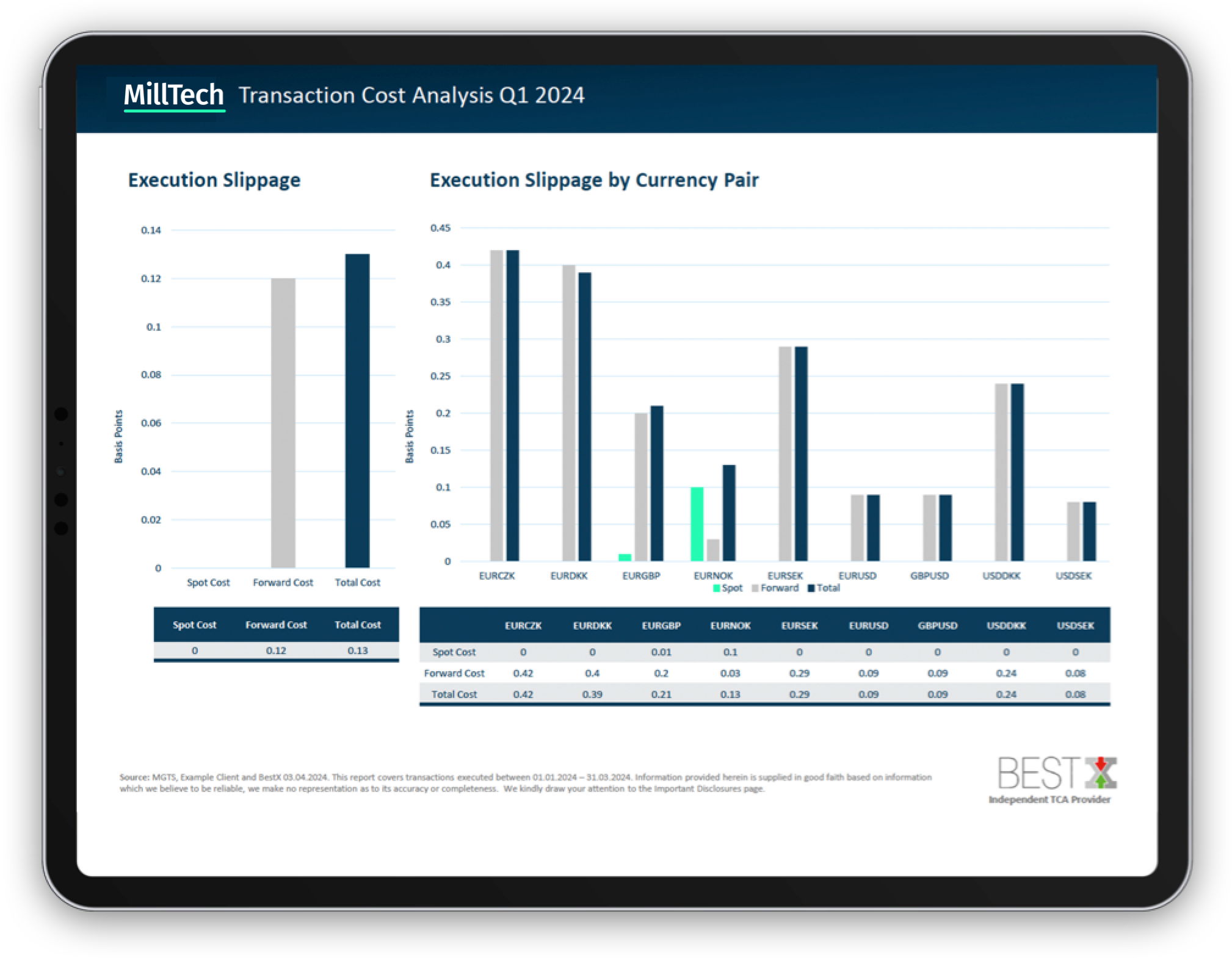

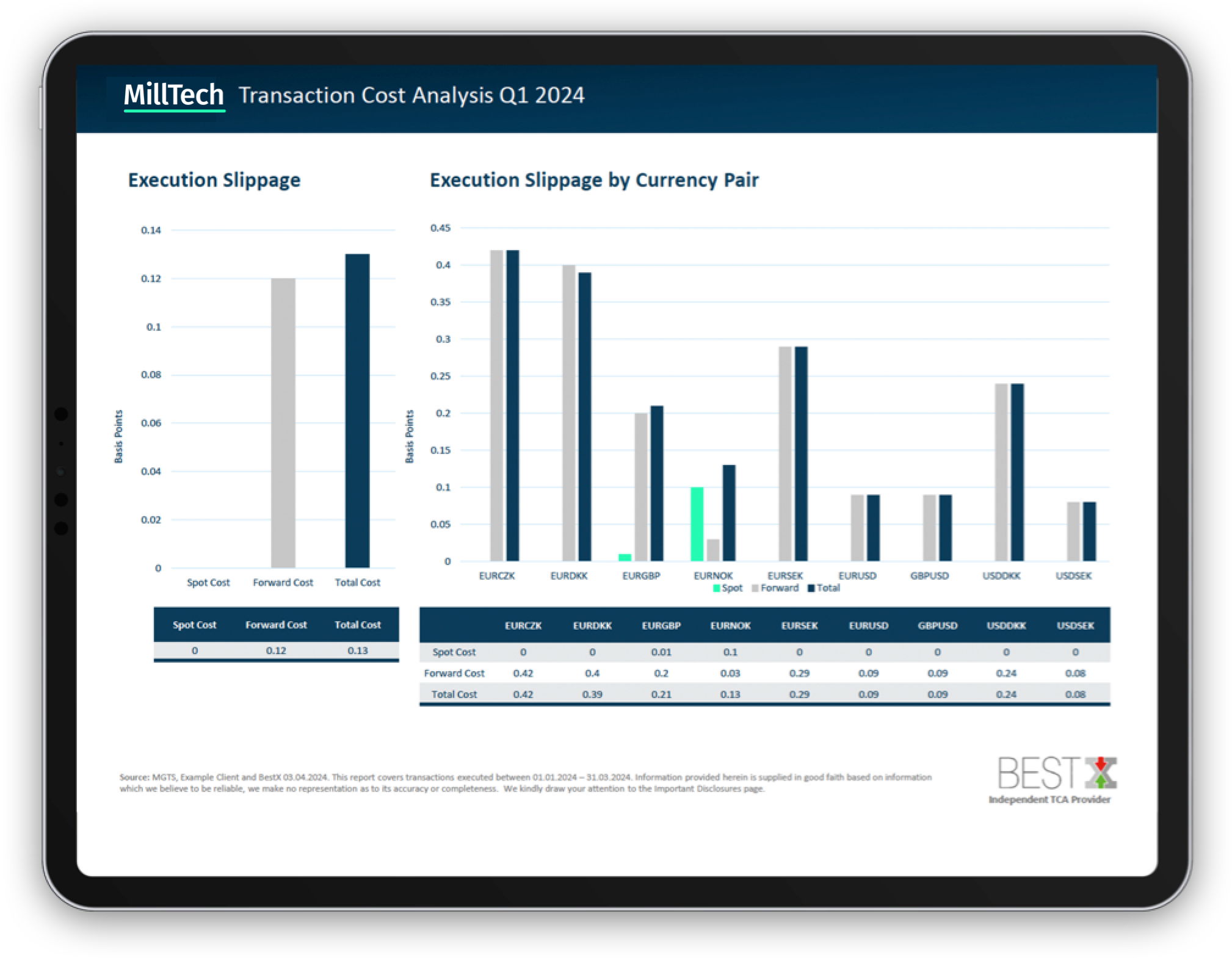

Identify your total cost from the MID

Benchmarking

Understand cost in the context of the wider market

Enhance Risk Management

Improve governance and oversight

Optimise returns

See how much yield is being left behindWhy independent audits are important

Third-party verification of FX costs

Access to broader market data and benchmarks

Analysis free from internal biases and conflicts of interests

Allows your team to concentrate on core business activities

Despite the obvious benefits, there are still misconceptions preventing businesses from implementing TCA.

See how independent TCA helps corporates and fund managers uncover hidden FX costs and optimise hedging strategies.

Access to competitive pricing and operational efficiency will always be critical factors for private equity firms when it comes to trading currencies...

Simply fill in both fields below and one of our friendly experts will be in touch shortly to discuss your requirements.